How to Trade on Binance: A Full Guide to Benefits and Risks

Binance is one of the largest and most popular cryptocurrency exchanges in the world. It offers a variety of features for both beginners and advanced traders. Here’s a step-by-step guide on how to trade on Binance, along with the benefits and risks involved.

How to Trade on Binance: Step-by-Step Guide

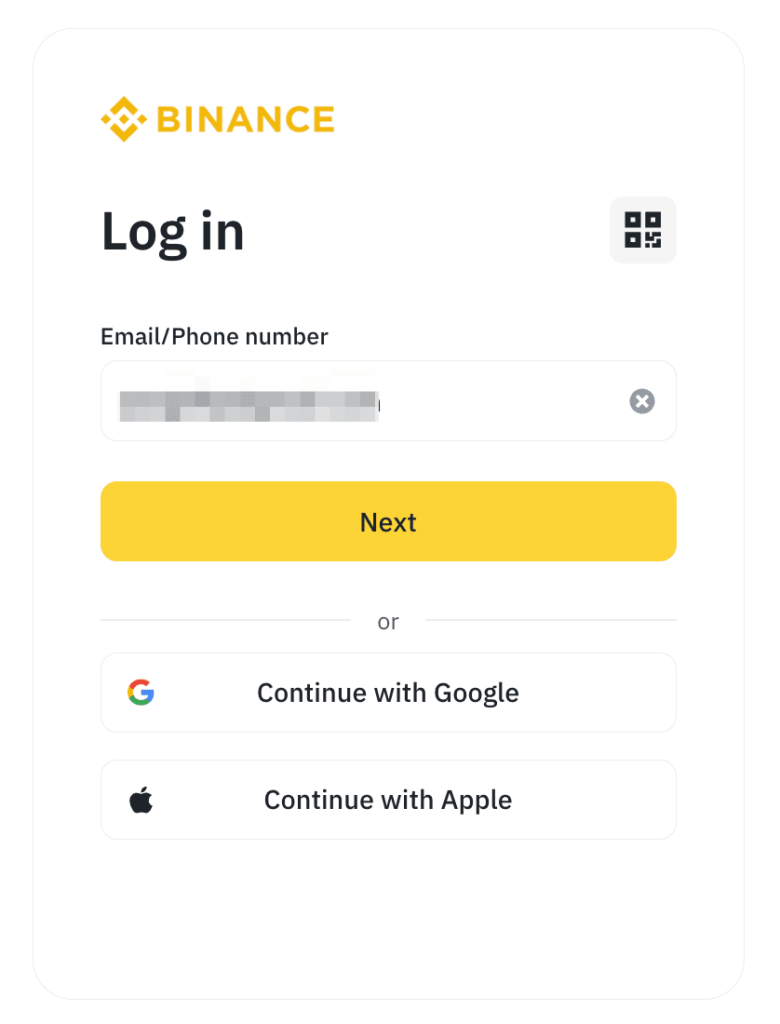

- Create a Binance Account

go to Binance and get free coins Sign up (Deposit 50$ and get Bonus futures)

Go to Binance’s website or download the mobile app.

Click on Sign Up and create an account using your email or phone number.

Verify your account by completing the KYC (Know Your Customer) process to ensure your account is secure and you can access all features.

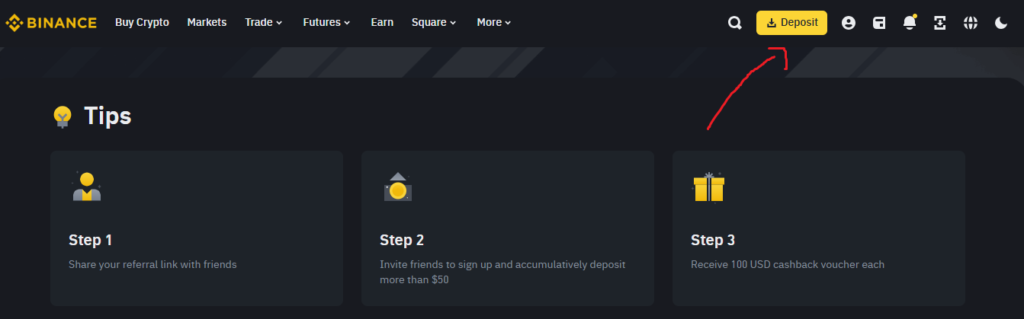

- Deposit Funds

Once your account is set up, you can deposit funds into your Binance wallet. There are two main ways to do this:

Deposit Cryptocurrency: If you already own cryptocurrency, you can transfer it to your Binance wallet by selecting “Deposit” and copying your wallet address.

Deposit Fiat (Traditional Currency): You can deposit fiat money (USD, EUR, etc.) through a bank transfer, credit/debit card, or even peer-to-peer (P2P) options. - Select the Trading Pair

Once funds are in your account, choose which trading pair you’d like to trade. Binance offers a wide range of pairs, such as BTC/USDT (Bitcoin to Tether), ETH/BTC (Ethereum to Bitcoin), etc.

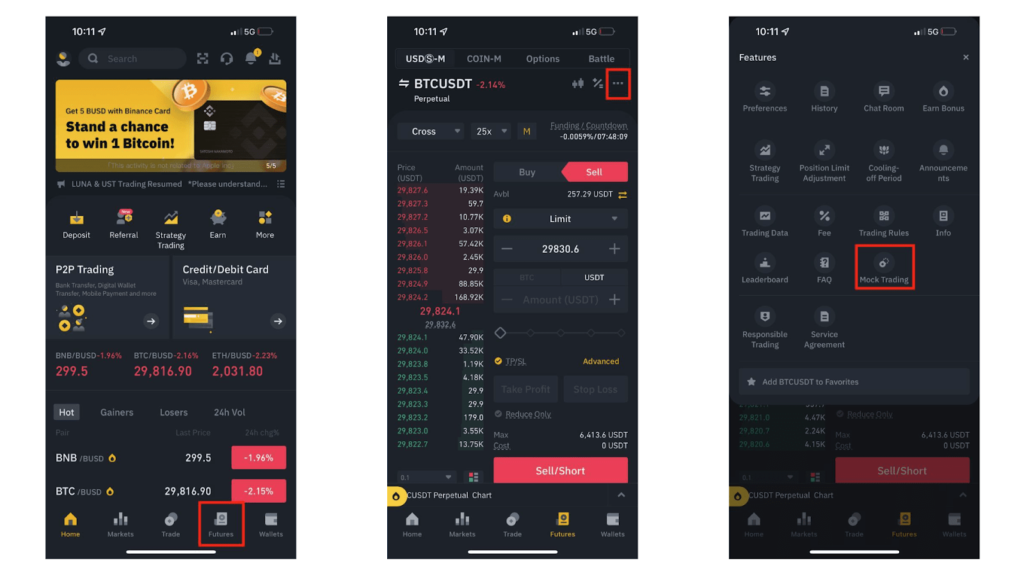

To find trading pairs, go to the Markets tab, select the market you want (Spot, Futures, etc.), and then search for the pair you want to trade. - Choose Your Trading Option

Binance offers several types of trading options:

Spot Trading: This is the basic trading option where you buy and sell crypto currencies immediately at the current market price.

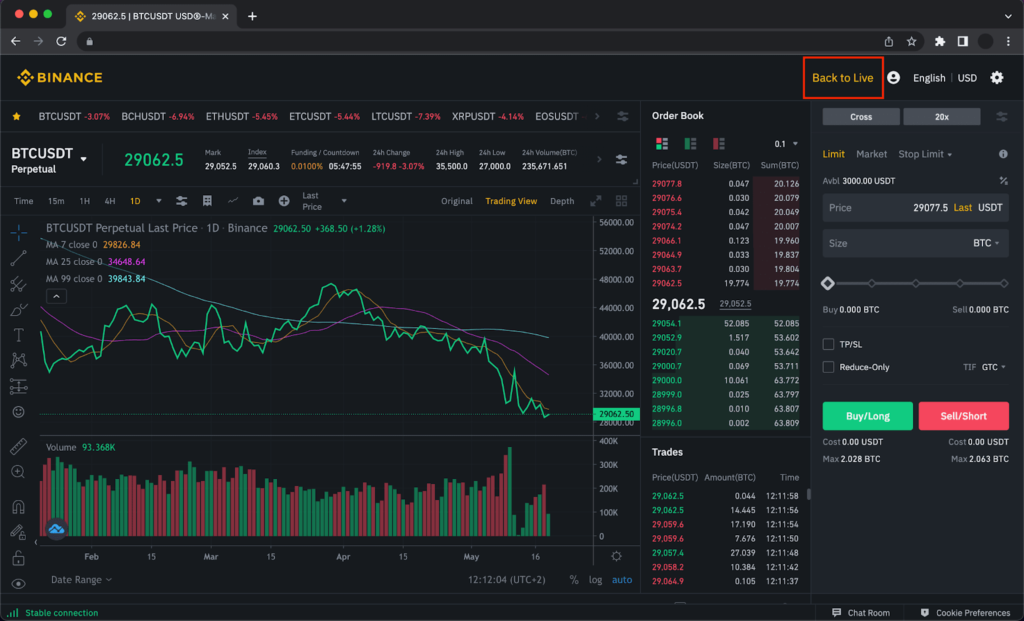

Futures Trading: Allows you to trade contracts that speculate on the future price of cryptocurrencies.

Margin Trading: Borrow funds from Binance to trade with leverage.

- Place Your Order

After selecting your trading pair, you can place an order:

Market Order: Buy or sell immediately at the best available price.

Limit Order: Set a specific price at which you want to buy or sell, and the order will execute when the market reaches that price.

Stop-Limit Order: Automatically executes a limit order when the market hits a predetermined price. - Monitor Your Trades

Once your order is executed, you can track your trades under the Open Orders or Order History tab. You can also monitor your balances in the wallet. - Withdraw Funds

To withdraw funds, navigate to Wallet > Spot Wallet > Withdraw. Select whether you’re withdrawing cryptocurrency or fiat, and follow the instructions.

Benefits of Trading on Binance

Wide Range of Cryptocurrencies

Binance offers a massive selection of cryptocurrencies (over 300+), which gives you many options to diversify your portfolio.

Competitive Fees

Binance offers one of the lowest fee structures in the industry, with a trading fee starting at 0.1% per transaction. Fees can be reduced further by using Binance’s native token, BNB.

Advanced Trading Tools

Binance offers spot trading, margin trading, futures, and staking. It also provides advanced charting tools, technical indicators, and a comprehensive order book.

Security

Binance has industry-standard security measures, including two-factor authentication (2FA), cold storage wallets, and an insurance fund for users’ funds in case of unforeseen events like hacking.

Global Access

Binance is accessible from most countries and supports multiple fiat currencies and cryptocurrencies. It also has peer-to-peer (P2P) trading features, which allow users to buy and sell crypto directly with others.

High Liquidity

Binance has a high trading volume, which means it’s easier to buy and sell crypto without slippage or price manipulation.

Educational Resources

Binance offers resources such as tutorials, articles, and a Binance Academy to help new traders understand how to trade and manage risks.

Risks of Trading on Binance

Volatility of Cryptocurrency Markets

The cryptocurrency market is highly volatile. Prices can fluctuate dramatically, leading to significant losses if trades are not carefully planned.

Leverage Trading Risks (Margin & Futures)

Trading with margin or futures contracts can amplify profits, but it also increases the risk of greater losses. You may lose more than your initial investment if things go against you.

Security Concerns

While Binance implements strong security measures, exchanges can still be targeted by hackers. Users should be vigilant and use tools like

2FA to protect their accounts.

Regulatory Uncertainty

Cryptocurrency regulations vary by country and are constantly evolving. In some regions, trading on Binance may be restricted or subject to future regulation, which can impact your access to the platform or funds.

Market Manipulation

The cryptocurrency market, especially altcoins, can sometimes experience manipulation by large traders or “whales.” This could lead to sudden price movements that cause unexpected losses for smaller traders.

Complexity for Beginners

Binance offers a broad range of trading options and advanced tools that might be difficult for beginners to understand. Trading without a clear strategy or knowledge can lead to losses.

Withdrawal Fees

While Binance has low trading fees, there may be fees associated with withdrawing cryptocurrencies or fiat from your account.

Tips for Safe Trading on Binance

Use Two-Factor Authentication (2FA):

Always enable 2FA for extra security.

Start Small:

If you are new to trading, start with a small amount of money to minimize potential losses while learning.

Use Stop-Loss Orders:

Set stop-loss orders to automatically sell your assets if their prices fall below a certain threshold, protecting you from larger losses.

Diversify Your Portfolio:

Don’t put all your funds into one cryptocurrency. Diversify your investments across several assets to spread risk.

Keep Up with News:

Stay informed about market trends, news, and events that might affect the cryptocurrency market, such as regulatory updates or technological developments.

Conclusion

Binance provides an excellent platform for both beginners and experienced traders due to its variety of features, low fees, and vast selection of cryptocurrencies. However, like any trading platform, it carries inherent risks due to market volatility, security concerns, and regulatory uncertainty. By understanding the platform, using security features like 2FA, and trading cautiously, you can minimize the risks and maximize your chances of success in the crypto market.

Always remember: Never invest more than you are willing to lose, and consider seeking advice from financial experts if you’re unsure about trading strategies.